#IFINANCE MAC PROFESSIONAL#

You'll develop key professional skills and work with our partner organisations on optional projects from day one. This will help you stand out from the crowd. We combine the latest research with many opportunities to apply it.

#IFINANCE MAC HOW TO#

You’ll learn to analyse financial decisions and the motivations behind them, and how to apply this knowledge in the real world. Receive a theoretical foundation in finance. Graduate prepared for a career in finance.

Please note: iFinance 5 is no longer available for Apple Watch.Develop in-depth knowledge of finance theory and learn to apply it in practice.

#IFINANCE MAC MAC#

When you buy the Mac version, you automatically get the iOS and iPadOS versions with your purchase – and vice versa. IFinance 5 is available for Mac, iPad, and iPhone.

Want to confirm whether the standing order for your rent payment was executed two months ago? Use iFinance 5 to find out in the bat of an eye!

#IFINANCE MAC FULL#

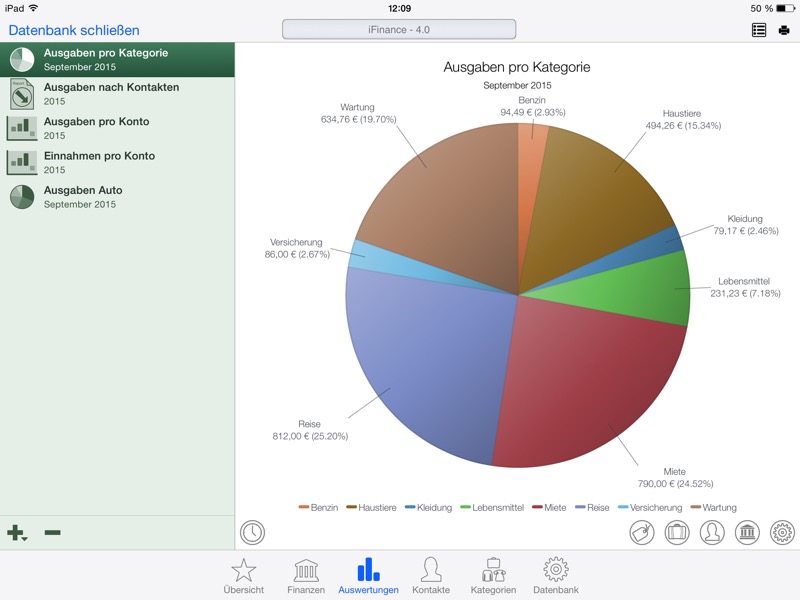

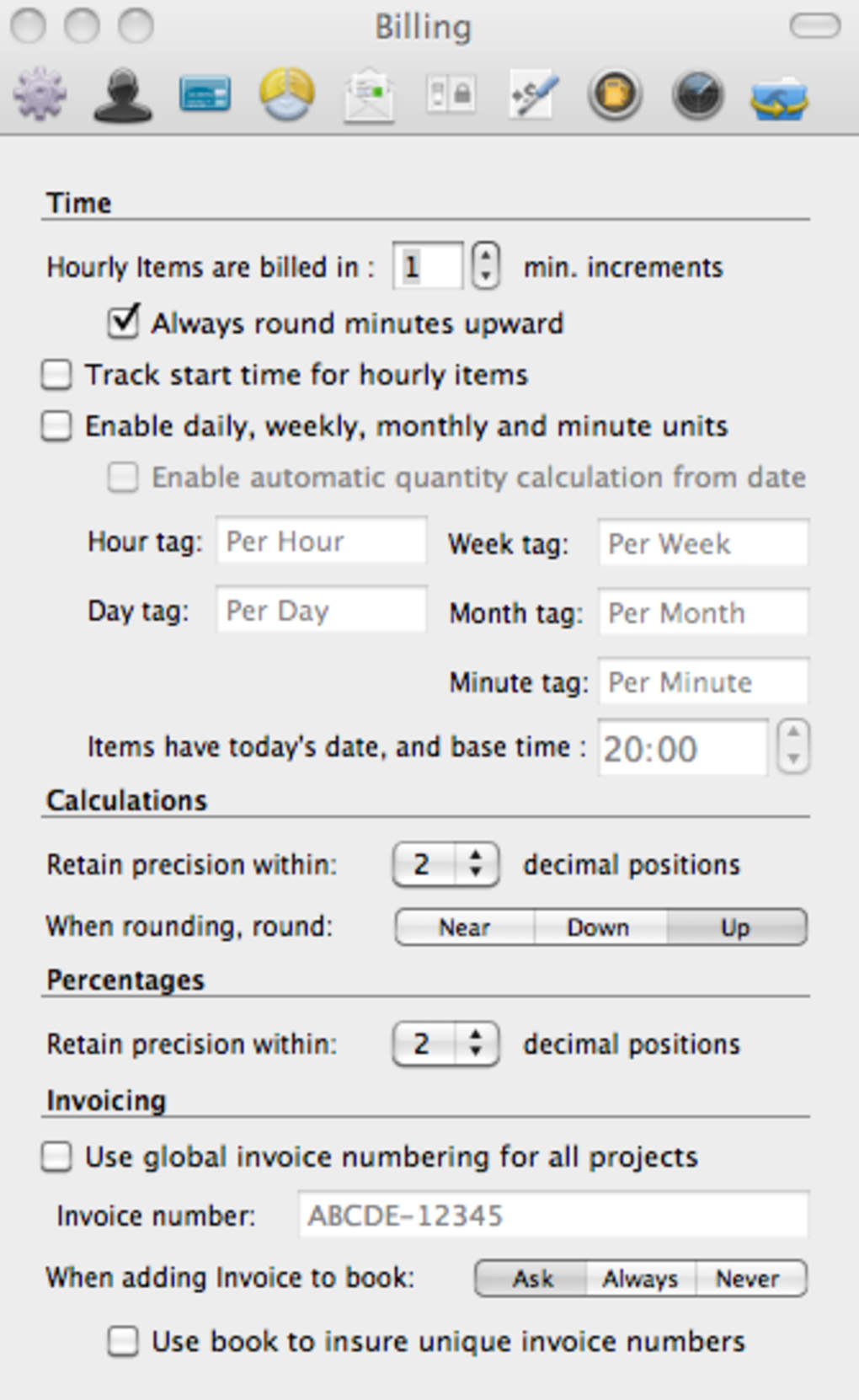

Want to look up how much you paid for your TV four years ago, and find the corresponding invoice? If this type of task requires you to get up and browse through folders or boxes full of paperwork, you'll love iFinance's integrated search tool. How much money is there left for you to spend today or this month without stretching your budget? How much more do you need to earn in order to hit your monthly income target? Review your financial goals using the app's actionable budgets. IFinance offers a broad range of easy-to-customize charts and reports. – Add file attachments to specific transactionsĬharts, Reports, Budgets, and Budgets Analysis – Supported file import formats: CSV, OFX, QIF, MT940 – Handle different currencies in one database – Analyze expenses, income, losses, and profits – Contacts (including contacts' bank details) – Categories (including automatic assignment) – Retrieve your account transactions – now available for banks in the US and Canada (requires a paid subscription) It can analyze your finances and helps you identify your biggest spending items and any categories with saving potential. Want to find out how your assets are performing? Or why you keep maxing out your bank account each month, leaving you to wonder where your salary actually goes? Is it current expenses such as rent, insurance, food or loans? iFinance has all the answers. The app's automatic category assignment, tags, budgets, and analytics tools help turn your account history into much more than just a list of bare numbers. iFinance's convenient evaluations and charts provide an at-a-glance overview of your income streams and expenditures so that optimizing your finances becomes a breeze. IFinance helps you keep track of your income and spending in the most convenient and fastest way.

0 kommentar(er)

0 kommentar(er)